Before you start with the below slideshow, I want to make it clear that all credits will have to go to this article, taken from one of the most interesting and detailed blog I have ever had the opportunity to read and follow. By all means, if you are here reading my stories, go pay The Woke Salaryman a visit. You will clearly enjoy it!

If there is anything good coming out of the whole COVID situation, that clearly has to be the special attention families have started to pay to their personal finance and personal budgeting. That being said, I feel like some are choosing to skip steps, focusing on “the end prize” instead of taking the time to create a solid plan. It’s like wanting to build a home and instead of poring a concrete slab to build on, you start with drawing the roof.

Now without wasting any more time, before we start discussing about the concept of FIRE and what that broadly means, let’s have a look at the easiest but at the same time extremely complex first aspect you have 100% control of it: your budget. Like any well-oiled machine, to keep your lifestyle afloat you need to put some “fuel” into it. In this case, the “fuel” is nothing other than your income and yes, during COVID (or any recession whatsoever) we all realized how fragile and sensible this aspect of our life can be. Well you are stronger than you think and you have to force yourself into finding alternative ways to keep going . One solution that will come handy is to lighten the load on your lifestyle. Easier said than done, ain`t it?

Let’s pause for a minute so you can go make a warm beverage. Stick with me here, all will soon fit into place if you have patience. Before you start searching & eliminate the “heavy load” on your lifestyle, you need o find your holding power, that is your step 1. In other words that is your cash cushion, a balance of money that you keep to protect yourself against what life throws in your face. There will always be a debate between this and an emergency fund, but in the end both of them have the same purpose: to keep you safe when needed. The appropriate size of a cash cushion depends on your spending habits and the place to keep it is for you to decide. Anything between 3 to 12 months of spending money will do just fine. My preference was to have one year of spending money, kept in a high income saving account (HISA) that will at least match the yearly inflation.

Now, to be fair there is no valid excuse to not track your monthly expenses. Do it how you want, use your local Excel or Google Sheet, use your laptop or a physical notebook, use whatever your feel like but don’t skip this step. At the very least, just split all your expenses into needs and wants. This is how you now advance to step 2, trimming all the fat. Don’t get me wrong, it’s up to you to decide what the fat is and by all means, you still need to keep some “good fat” to keep functioning at the right level. Sometimes it’s just about looking for more affordable alternatives that give you the same or, why not, better value.

Not all the fat is as easy to be trimmed as snapping your fingers and I’m sure you know how hard is to have a “six pack”. I, for one, found that the hard way, but it’s not about me now so let’s get back to finance and that is step 3. Some big purchase made in better times will make you’re life difficult and this is the moment you may consider a deferred plan to help you with the cashflow – in other words, this is a flexible payment option or agreement between a lender and a borrower where the borrower pushes their payments back to a later date. This arrangement is often made when the borrower can’t pay immediately but the lender is willing to make accommodations. The borrower can continue to use whatever they are borrowing, but they may have to start paying interest on it. Be wise and fool yourself not, paying more interest means your pay a higher amount overall. Treat this only as a temporary shot-solution for a long-term problem.

What did I told you in the beginning in this article , the puzzle is not impossible when you take your time to breath and think. Little by little, you are now moving to step 4 where you can think and act like an investor without being one yet. This is how you learn about the main three controls a smart investor should have:

– breakeven cost: amount of money, or change in value, for which an asset must be sold to cover the costs of acquiring and owning it. It can also refer to the amount of money for which a product or service must be sold to cover the costs of manufacturing or providing it. Click here for more details

– cost-per-use: is the idea that the value of an item is directly related to how much use you get out of it. The more use you get from an item, the more you should expect to pay for it. The ‘sweet spot’ of a purchase, then, is the one that has the most uses for the cost.

– cost vs benefits: a process businesses use to analyze decisions. The business or analyst sums the benefits of a situation or action and then subtracts the costs associated with taking that action. Click here for more details

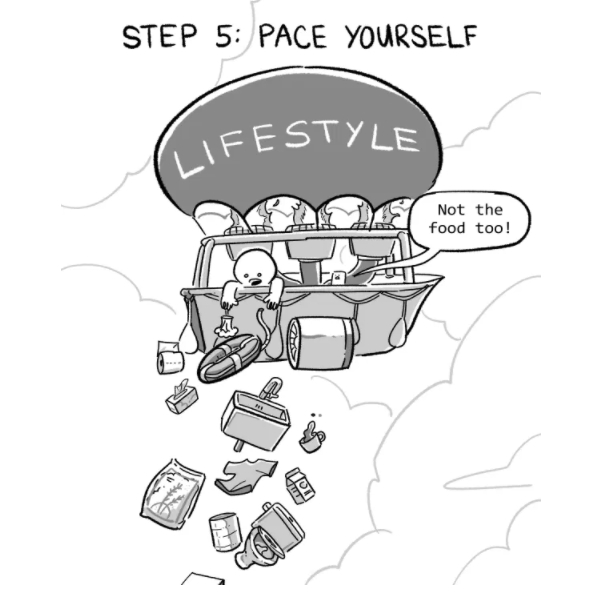

Now that you get a good grip of how things are working, don’t go overboard. The goal is to cut costs and this is where some push it to the extreme. For each their own, there is no judgement on that, but be careful because if not applied correctly, this strategy can do more damage than good. Yes, you guessed it, this is step 5 of your plan. Being frugal is sometimes misunderstood, cutting your expenses at the expense of your mental and physical health. though it will look good for your wallet it’s definitely bad for the long-term. I like to call this the “whatever makes me sleep good at night” factor and I would say, there is no wrong in choosing yours.

Seems a bit complex, but it is not if you give it time. For me it is working, but by all means, you take only what you feel it applies to your style. Once again, I have to be grateful for the visuals took from The Woke Salaryman and I can only hope you will also pay them a visit.